$DIA: 200-day moving average of Dow Jones Industrial Average Bear market rallies fall hard after they stall (just as pullbacks in bull markets lead to sharp rallies). The SPDR S&P 500 ETF ($SPY) spent most of 2022 below its declining 200-day MA, but tested that resistance level a few more times than $QQQ.Īs with $QQQ, each $SPY rally attempt failed after running into its 200-day MA, leading to a new wave of selling and lower lows every time:Īfter each rejection at the 200-MA, notice the price also fell back below the shorter-term 20-day MA within two weeks. $SPY: 200-day moving average of S&P 500 Index The opposite of this basic rule of technical analysis is also true.

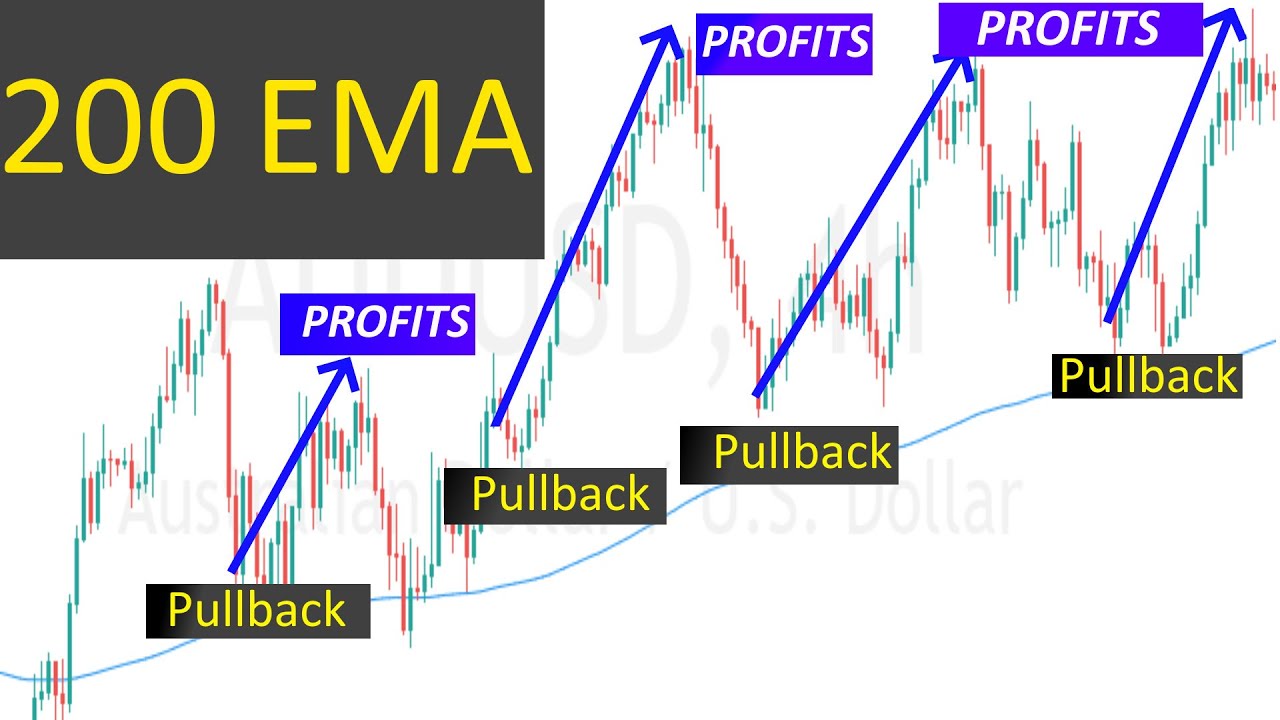

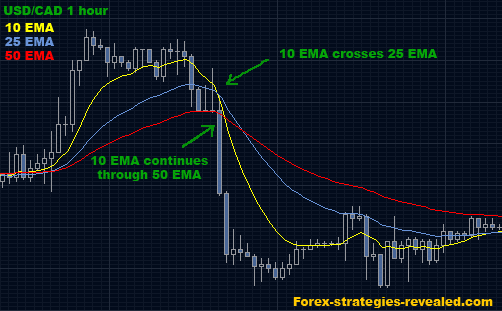

It’s been 9 months since $QQQ touched the 200-day MA, but the next market rally attempt could quickly lead to a new test of Nasdaq’s 200-day moving average.īy the way, the $QQQ chart above clearly demonstrates how a prior level of support becomes the new resistance level-after the support is broken. $QQQ again tried to break out two months later, but resistance of the 200-day MA crushed the rally attempt each time: This is not surprising, as funds typically rotate out of tech growth stocks and into less volatile sectors in bear markets.īelow, notice that $QQQ fell below support of its 200-day moving average (orange line) in January, then ran into new resistance of that same level when stocks rallied a few weeks later. $QQQ, a popular ETF that tracks the Nasdaq 100 Index, showed the most weakness of all the major index ETFs in 2022. $QQQ: 200-day moving average of Nasdaq 100 Index Now that you understand what the 200-day moving average is and how it works, let’s see it in action on charts of the main stock market indexes. Overall, the 200-day moving average is a fantastic indicator due to its long-term perspective, widespread use, and potential to act as a level of support or resistance. This can be useful for traders and investors looking to enter or exit positions based on whether an index or stock price is able to break through the 200-day moving average. It can act as support or resistance: Most importantly, the 200-day MA is a highly reliable indicator of support or resistance (as the following charts will show).Its popularity makes it a self-fulfilling indicator, as traders may buy or sell based on whether the price is above or below the 200-day MA. It is widely followed: The 200-day moving average has the potential to influence market sentiment because it is such a well-known indicator among traders and investors.It’s also effective for swing traders following a trend-trading strategy. If you’re an investor with a long-term horizon, this allows you to focus on the “big picture,” rather than getting caught up in short-term noise. It is a long-term indicator: By smoothing out short-term price fluctuations, the 200-day MA easily gives you a better sense of the underlying trend over a longer period of time.There are a few reasons why the 200-day moving average is such an effective and reliable technical indicator: Why is the 200-day moving average strategy so effective? When used with other key indicators such as price action and volume, the 200-day moving average provides an excellent way to ensure you’re always on the right side of a stock’s trend.Ĭontinue reading to discover how the 200-day MA works to reduce your risk, while increasing your odds of success. Simply put, the 200-day moving average is fantastic for quickly determining the long-term trend of the S&P 500, Nasdaq, and any individual stocks. The resulting average is then plotted on a chart, along with the stock’s actual price. To calculate the 200-day moving average, you simply take the sum of the stock’s closing prices over the past 200 days and divide it by 200. It is used to smooth out day-to-day price fluctuations, and provide a clearer picture of the dominant trend.

The 200-day moving average (200-day MA) is a popular technical analysis indicator that calculates the average price of a stock or index over the past 200 days. Why Is The 200-Day Moving Average Different Than the 50-Day Moving Average?.How Can I Find the 200-Day Moving Average for a Stock?.What happens when a stock goes below 200 day moving average?.Where can I find the 200 day moving average?.What is the 200 day moving average rule?.FAQ: Frequently Asked Questions about the 200-day moving average.Best ways to use the 200-day moving average.

200-day moving average levels to watch in 2023.

0 kommentar(er)

0 kommentar(er)